Dowry Insurance

Dowry Insurance: Allah Almighty has created other animals and humans in pairs to protect His creation and has declared marriage obligatory between capable men and women. At the time of marriage, the spouse must be given a endowment; this is a extraordinary right given to the spouse by her spouse in Islam.

Regarding the payment of dowry in marriage, Allah has commanded in the Holy Quran, Surah An-Nisa, verse 4, “And give the women their dowry with joy.” In the Hadith Sharif, among the specific principles for the conclusion of marriage, the dowry due to the woman has been declared to be payable by the husband. If this Dowry Insurance is not paid, she will have to answer for it on the Day of Judgment.

Under this plan, there is a guarantee of payment of the dowry given to the wife by the husband. Under this plan, an amount equal to the Dowry Insurance is insured. However, if desired, a higher amount can also be insured.

Who is eligible

The Life Insurance Corporation has launched the Deenmohar Insurance for religiously committed unmarried men or those who have already completed their marriage but have not paid the deenmohar.

Through this protections, they can spare for the reason of paying the endowment for marriage. The nominee for this insurance must be a wife. However, those who have not completed their marriage can give the name of a nominee after marriage.

Features and Benefits

- Minimum sum insured 2,00,000.00 (Two lakh taka and maximum sum insured as per financial capability.

-

- Premium payment method: Semi-annual and annual

Denmohar Insurance (with profit)

- Term: You can take a policy with a term of 5, 10, 11, 12, 13, 14, 15, 20 years. You can take ancillary benefits with the main policy.

- If the insured survives until the maturity of the insurance, the insurance amount along with the earned bonus will be paid to the wife, subject to proper certification by the insured/insured.

- If the premium payer (husband) dies during the insurance term, the insurance amount along with the earned bonus will be paid to the wife.

- As per the terms of the insurance, the insured will be entitled to surrender and take loans.

- Income tax rebate will be available on the premium and there is no rebate on large sums of insurance and payment methods.

- You can change the term of the policy within 2 years, subject to the decision of underwriting.

- After paying the premium for two years, the policy will achieve the paid-up value.

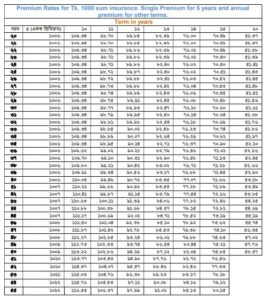

- For a term of 05 (five) years, the premium will be the same as the Single Premium policy.

- The posthumous claim amount is exempt from income tax.

- In case of divorce, the policyholder can change the nominee by submitting his divorce papers.

Example:

If a person of 28 years of age takes a dowry insurance of 5 lakh taka from the Life Insurance Corporation, his premium and post-term claims are as follows:

(a) For a term of 10 years, the annual premium is 109.38×500= 54,670/-, total deposit is 5,46,700/- taka. At the end of the term, he will get 6,00,000 taka including the bonus (as per the current bonus rate). If the insured dies before the maturity, then the principal sum assured along with the earned bonus will be paid to the wife.

(b) For a term of 12 years, the annual premium is 89.89500 = 44,945/- taka, total deposit is 5,39,340/- taka, at the end of the term, he will get 6,98,000/- taka including the bonus (as per the current bonus rate). If the insured dies before the maturity, the principal sum assured along with the accrued bonus will be paid to the wife.

(c) For a term of 20 years

Annual premium 51.51×500 – 25,755/- Taka, total deposit 5,15,100/- Taka. At the end of the term, you will receive 10,10,000/- Taka along with bonus (as per the current bonus rate). If the insured dies before the maturity, the principal sum assured along with the accrued bonus will be paid to the wife. Dowry Insurance

Documents required for claim settlement:

In case of post-maturity claim:

- 1. Insurance document,

- 2. Photocopy of the cheque book of the insured’s bank account,

- 3. Photocopy of the national identity card and other documents, if applicable.

In case of post-mortem claim:

Documents required in support of the claim-

1. Insurance document,

2. Claim form,

3. Photocopy of the nominee’s bank account check book

4. photocopy of the national identity card,

5. Death certificate,

6. Cemetery certificate,

7. Chairman/Councillor’s certification letter and other documents as applicable.

Related post: Car insurance claim